By Cynthia Strathmann, Executive Director

January 23, 2026

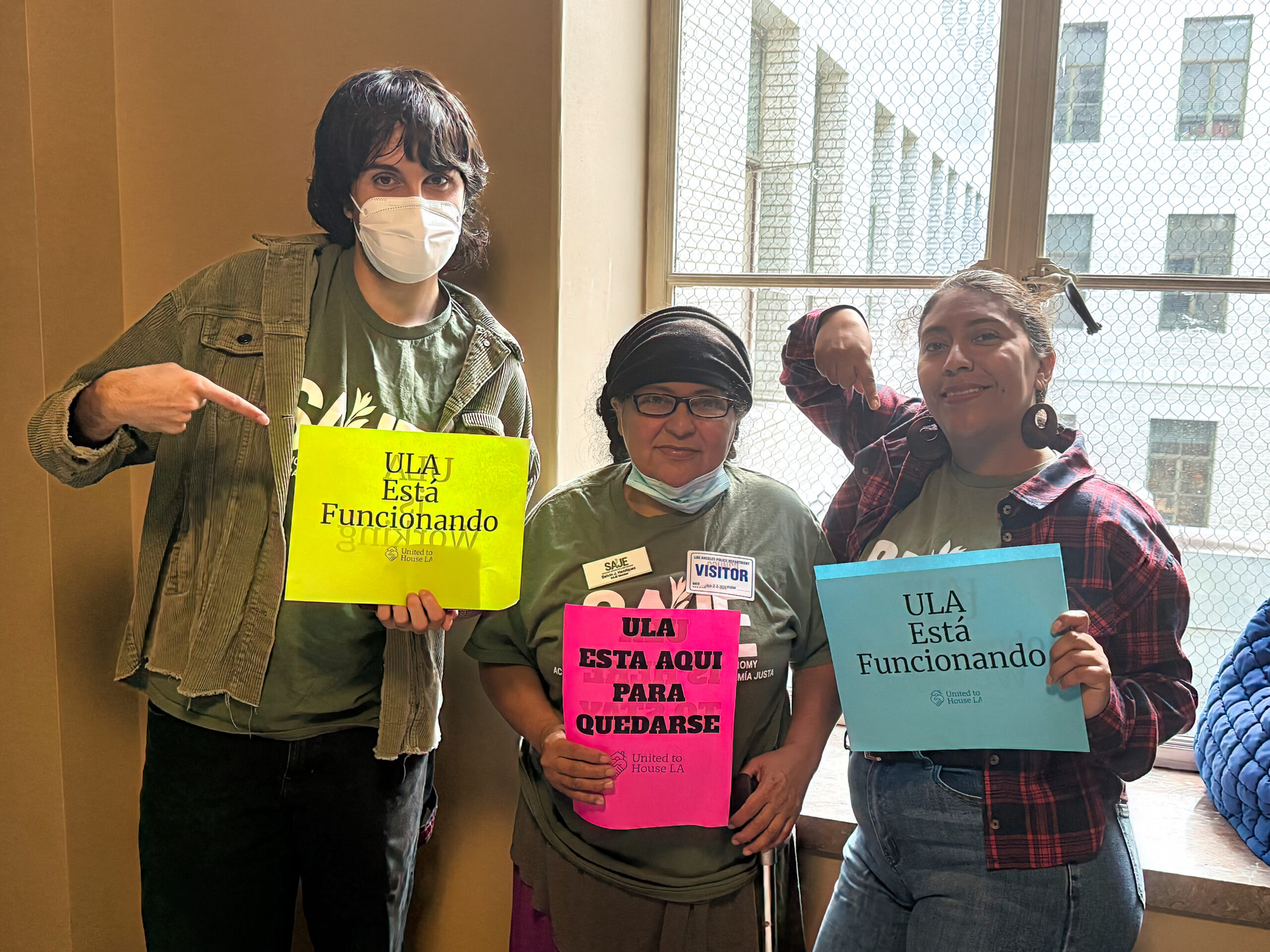

Today, Councilmember Nithya Raman (CD4) introduced a motion to place a measure on the June 2026 ballot that would amend Measure ULA to create 15-year exemptions on new construction for multifamily and commercial property sales, among other changes. SAJE staff and members were there to oppose the motion.

During proceedings, Councilmember Raman clarified she supports the idea of ULA, but is concerned about its effects on the real estate market. Raman seems to be buying what real estate interests are selling—and unfortunately it’s not affordable housing.

Why would anyone trust a thing real estate interests say about ULA? These are the same voices that encouraged a rush to sell before ULA’s April 1, 2023 implementation date, and then proposed ways to avoid the tax altogether, such as pricing buildings at $4.99 million or dividing large single properties into smaller, lower-priced parcels and selling them each separately. They even tried to sue ULA out of existence; that challenge was tossed by the California Superior Court in October 2023. None of it worked, so now they’ve pivoted to a new argument: ULA is slowing down multifamily building sales.

But is that true?

ULA has been in effect since 2023. It is true that property sales in Los Angeles declined between 2023 and 2024, as they did in New York, Chicago, San Diego, and Philadelphia. That’s because Los Angeles is subject to the same set of macroeconomic factors that are causing declines in every major U.S. city: higher interest rates. Between January 2022 and January 2023, three months before ULA went into effect, the 30-year-fixed-mortgage interest rate doubled to 6.48%. As the cost of borrowing money goes up, financing becomes more challenging, and projects and sales stall.

In fact, the Los Angeles County multifamily market has been on an upswing, with the amount of units sold increasing in 2024 and 2025 following a low in 2023. According to Compass Real Estate just this week, “Investor demand appears to be improving despite the increased tax liability,” referring to ULA.

There is a lot of noise in L.A.’s housing market—inflation, rising construction and insurance costs, interest rates, tariffs, and even the impact of the 2025 wildfires. There also continues to be a lot of uncertainty about whether or not ULA will last—which today’s motion contributes to. By continuing to try to weaken ULA, developers create the same uncertainty they say harms development. By capitulating to their complaints, city leaders signal that the real estate industry should hold out until it gets what it wants, no matter the cost. In the end, it may be that this uncertainty is primarily responsible for driving real estate developers to wait on projects, just a few more months, to see how things shake out.

The amendments proposed today would reduce who pays into ULA and delay when revenue is collected. This will make it more difficult to solve our affordable housing crisis. It’s imperative we stay the course and give a chance to let ULA work. And that means not losing our nerve every time L.A.’s real estate industry gins up another misleading narrative.